Trading Bots

In the volatile cryptocurrency market, the axiom "time is money" is more relevant than ever. Manual transactions slow down processes, lead to missed opportunities and reduce trading profitability. That is why on top exchanges such as Binance and Coinbase, up to 80% of transactions have long been closed by trading bots that react instantly to any changes and automate the trader's work.

We offer development of trading bots to optimize trading operations. Our developments include the use of advanced technologies and methods, which ensures a high level of data protection and efficiency.

How Cryptocurrency Trading Bots Work

Trading bots for cryptocurrencies or traditional financial markets are automated programs designed to buy and sell assets based on pre-set parameters. They analyze large amounts of data and make trades based on set indicators and parameters, allowing traders to implement trading strategies of any complexity and with minimal involvement.

To make trading decisions, bots can use the following indicators:

- Moving averages.

- Relative Strength Index (RSI).

- Bollinger Bands.

- Moving Average Divergence (MACD).

- Trading volumes.

- Asset value.

- Time period.

- Order book data.

Manual processing of all this information takes a significant amount of time from the trader, which, in the conditions of high volatility of the crypto market, negatively affects the effectiveness of trading. The bot takes a split second to do this, and it is also able to work around the clock, without fatigue, emotions, and breaks.

As a result, using such a tool in exchange trading allows you to close more profitable deals and minimize the risks associated with the human factor.

On which exchanges can you launch trading bots?

Trading bots can be launched on a variety of cryptocurrency exchanges, many of which provide open APIs to automate trading strategies. Here are the most popular ones:

- Binance is one of the largest crypto exchanges in the world that supports the launch of trading bots via API.

- Kraken is a popular exchange, especially among European users. It supports trading bots and offers a variety of trading tools.

- OKX is an exchange with good liquidity and the possibility of automated trading using API.

- Huobi is a well-known Asian exchange with a large number of trading pairs and a high level of security.

- Bybit - specializes in derivatives and supports the use of trading bots.

Bots are also widely used for trading on stock exchanges. This opportunity is provided by the largest and most reputable market players - New York Stock Exchange, NASDAQ, London Stock Exchange and many others. Most often, the use of bots on them is allowed through brokers and specialized platforms, such as Interactive Brokers and Saxo Bank.

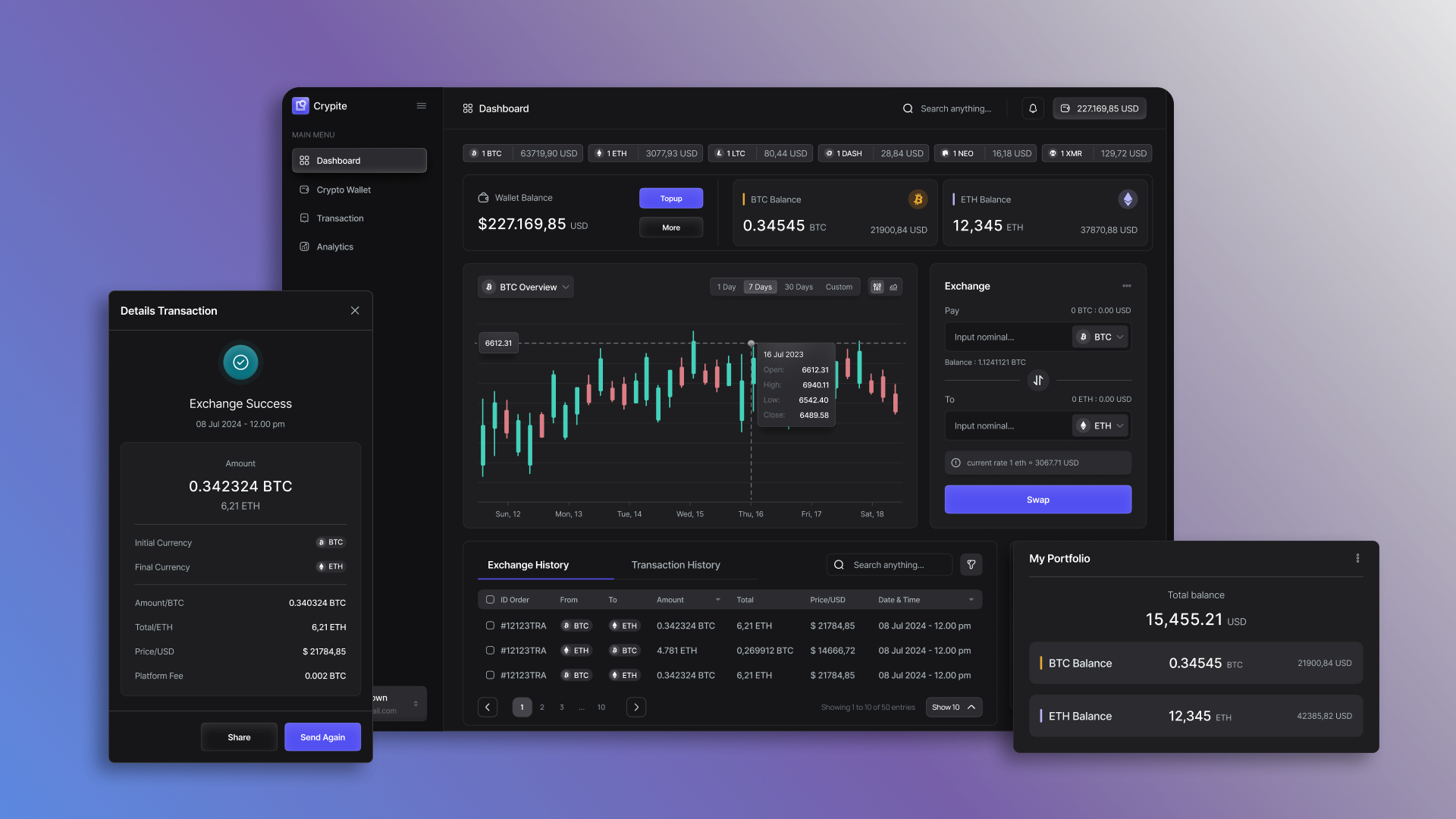

Trading Bots Functionality

A cryptocurrency trading bot should take into account the specifics of the crypto market and provide reliable functionality that will help a trader automate his work and make profitable deals in conditions of high volatility of currency quotes.

Main functions of the trading bot:

- Data collection and analysis. Continuous monitoring and analysis of disparate data - prices, trading volumes, indicators and other indicators, to assess the real situation on the market and update forecasts.

- Decision making. Automatically making decisions about opening and closing trades, or adjusting current positions, in order to extract the greatest profit.

- Trade execution - The technical execution of trading operations, such as placing orders, selling currencies, or managing open positions, to minimize the workload on the trader.

- Risk management. Effective risk management to minimize financial losses. In particular, the bot should be able to automatically close unprofitable transactions (stop losses) and fix profits when reaching the target (take profits), as well as assess potential threats when concluding transactions.

- Security. Ensuring reliable protection of assets and confidential information of the trader from possible hacks, cyber attacks and other threats.

Benefits of Using Trading Bots

Trading bots for crypto exchanges play an important role in the successful work of traders. They have the ability to analyze huge amounts of market data and act faster than a person. This makes them an indispensable tool for those who want to improve the efficiency of their strategies, minimize risks and increase profits.

As Elon Musk said: "Bots are the future of commerce. Those who can use them effectively will be at the forefront of the digital revolution."

Let's take a closer look at the benefits that trading bots provide to traders:

- Automation and optimization. Bots instantly respond to any market changes, and also provide the ability to conduct backtesting - testing and optimization of strategies on historical data. This increases trading efficiency and minimizes risks.

- No Emotions : Bots trade based on pre-defined and clear strategies, eliminating the influence of human emotions such as fear and greed that can lead to irrational decisions.

- Multifunctionality. One bot can monitor multiple markets and assets simultaneously, allowing you to effectively distribute risks and cover more trading opportunities.

- Data analysis: Bots can analyze huge amounts of data and use complex mathematical models to make decisions, making them extremely effective at implementing complex trading strategies.

- Time saving. Bots can work 24/7 without breaks and automate routine tasks of a trader. They also allow trading on global markets operating in different time zones.

Main types of trading bots

There are different types of trading bots, each designed to implement specific trading strategies and tasks. Let's take a closer look at the most common ones:

- Trend bots. Used to identify and follow market trends. They analyze the direction of price movement and open positions in the direction of the main trend, whether it is ascending (bullish) or descending (bearish). Trend bots are effective in markets with pronounced movements, but can incur losses in flat (sideways) conditions.

- Arbitrage bots. Such bots help to make a profit from the difference in the price of one asset on different crypto exchanges and markets. They instantly determine the difference in cost, after which they buy the asset on one platform where the price is lower, and sell it on another where the price is higher, earning on the difference in quotes.

- Market making bots. They create liquidity in the market by placing buy and sell orders at the same time near the current market price. They help to earn on the spread — the difference between the buy and sell prices — and also increase liquidity for cryptocurrency pairs.

- Scalping bots. They make many short trades with small profits, thereby generating profits on the slightest changes in quotes. Most often, such bots work with high-frequency strategies that require minimal time delays and low commissions for transactions.

- Grid trading bots. Place buy and sell orders at regular intervals, creating a grid of orders. This method allows you to earn on every price move up or down, regardless of the market direction.

Examples of successful trading bots

Given the saturation of the market, finding the best crypto trading bot is not the easiest task. We have selected for you some of the most successful options that are trusted by traders and quite popular in the crypto industry. However, you need to understand that all of them are standard solutions, which means:

- Limited functionality - the lack of flexibility often prevents a trader from adapting the bot to their unique strategy or market conditions.

- Lack of uniqueness - ready-made bots are available to many users. This reduces their effectiveness due to the mass application of the same strategies.

- Developer dependency - if the bot provider delays updates or stops supporting the bot altogether, it quickly becomes ineffective, or even unusable in a changing market.

- Security and privacy - you trust the bot with your crypto assets and also give it access to your exchange accounts. Therefore, if the developer has not taken care of reliable protection, this may lead to data leakage or unauthorized actions.

- Limited backtesting capabilities – many standard bots do not provide sufficient backtesting tools, making it difficult to test their effectiveness before live trading and potentially resulting in losses.

However, if you have never used bots in your work, ready-made solutions can be a great opportunity to quickly and relatively inexpensively try out such a tool in practice. In addition, this will help you formulate specific requirements and expectations before starting individual development. Therefore, we suggest considering examples of popular cryptocurrency bots on the market:

- Coinrule is an automated bot that allows you to create and run trading strategies without the need for programming. It supports over 10 cryptocurrency exchanges and is quite easy to use.

- CryptoHopper is a cloud-based cryptocurrency bot that allows users to automate trades across multiple exchanges using a variety of strategies, including signal trading.

- Shrimpy - supports multiple exchanges and offers copy trading capabilities, allowing you to replicate the strategies of successful traders.

- TradeSanta is another cloud-based trading bot that automates cryptocurrency trading. It supports various strategies, including scalping, grid trading, and DCA, and integrates with many well-known exchanges.

Ready-made solutions can help in the initial stages and give a general idea of how trading bots work, but it is important to remember that they have limited functionality and use universal approaches. For long-term success and maximum efficiency, you will need a customized solution designed for your own strategies, goals and market characteristics.

Stages of developing a custom trading bot

Creating an effective cryptocurrency bot requires the use of advanced and reliable technologies, as well as highly qualified technical specialists. The development process itself can be divided into several successive stages:

- Defining goals and strategy.

- Development of technical specifications.

- Designing the bot architecture.

- Development of algorithms for market data analysis and forecasting.

- Implementation of risk management mechanisms

- Integration with exchanges.

- Testing and optimization.

- Launch in real trading.

- Support and further development.

Each of these steps is critical, but the key element of a trading bot is the algorithms. They make decisions based on market information analysis, and their accuracy and efficiency directly affect the profitability and stability of trading. Therefore, when developing bots, our specialists pay special attention to this stage.

An equally important stage is bot testing, since any inaccuracies and errors in the algorithm code can lead to significant financial losses. Therefore, before the bot is launched in a real environment, our QA engineers conduct a multi-level code check to identify and eliminate any vulnerabilities.

Features of developing trading bots: technologies and tools

In our company, the process of developing cryptocurrency bots is based on the use of modern technologies and tools that not only automate trading strategies, but also provide a high level of security. This is necessary to protect traders' funds and minimize risks in volatile cryptocurrency markets.

We use Python, PHP, C++/C# and JavaScript (Node.js) as our core technology. They enable us to create robust and scalable systems that can efficiently process large amounts of data in real time.

Another important component of the bot's technical architecture is the ccxt library. It provides integration with multiple cryptocurrency exchanges, including Binance, Kraken, and Bitfinex, and allows for secure trading operations.

To improve the accuracy of market data analysis and risk management, we implement ML and AI models trained on historical data. They are capable of analyzing huge amounts of data and identifying hidden patterns that help predict market changes and minimize potential losses. We build their implementation on the Pandas, NumPy and Scikit-learn libraries, or using the TensorFlow and PyTorch platforms for more complex projects.

Why Choose AVADA MEDIA for Trading Bot Development

AVADA MEDIA provides services for the development of individual cryptocurrency bots that ensure high speed, accuracy and reliability of operations. We create each new solution taking into account the unique needs and strategies of the trader, which will allow you to gain a technological advantage in competitive crypto markets and improve the effectiveness of your trading.

If you are looking to automate your trading processes and increase profitability in the cryptocurrency market, contact our experts. We will help you create a solution that best suits your needs and strategies.

-

Buy a crypto trading bot or invest in developing a custom solution - what do you recommend?

Buying ready-made trading bots is a quick solution. However, they are often limited in functionality and do not allow you to quickly adapt strategies to rapidly changing market conditions. At the same time, a custom solution requires more time and investment at the start, but gives you complete freedom of action and maximum flexibility in settings, which allows you to extract more profit from trading. Therefore, the choice here depends on your budget and goals.

-

What technologies are used to create trading bots?

At AVADA MEDIA, we use modern programming languages, including Python and JavaScript, frameworks, cryptocurrency exchange APIs for integration with markets, and many other tools to create trading bots. Additionally, we can use machine learning and data analysis algorithms to improve the accuracy of trading decisions.

-

How to ensure the security of trading bots?

We ensure the security of trading bots using data encryption, multi-factor authentication, and the use of secure APIs when connecting to exchanges. Additionally, we conduct regular code audits and activity monitoring to promptly identify and eliminate possible vulnerabilities.